| freeamfva | |

| freeamfvaのブログ | |

| 年代 | 30代後半 |

|---|---|

| 性別 | 女性 |

ブログライター

ブログ

| TITLE. Failing to Trade Forex News? Do This Instead |

DATE. 2022年08月22日 17:10:03 |

THEME. 未分類 |

|

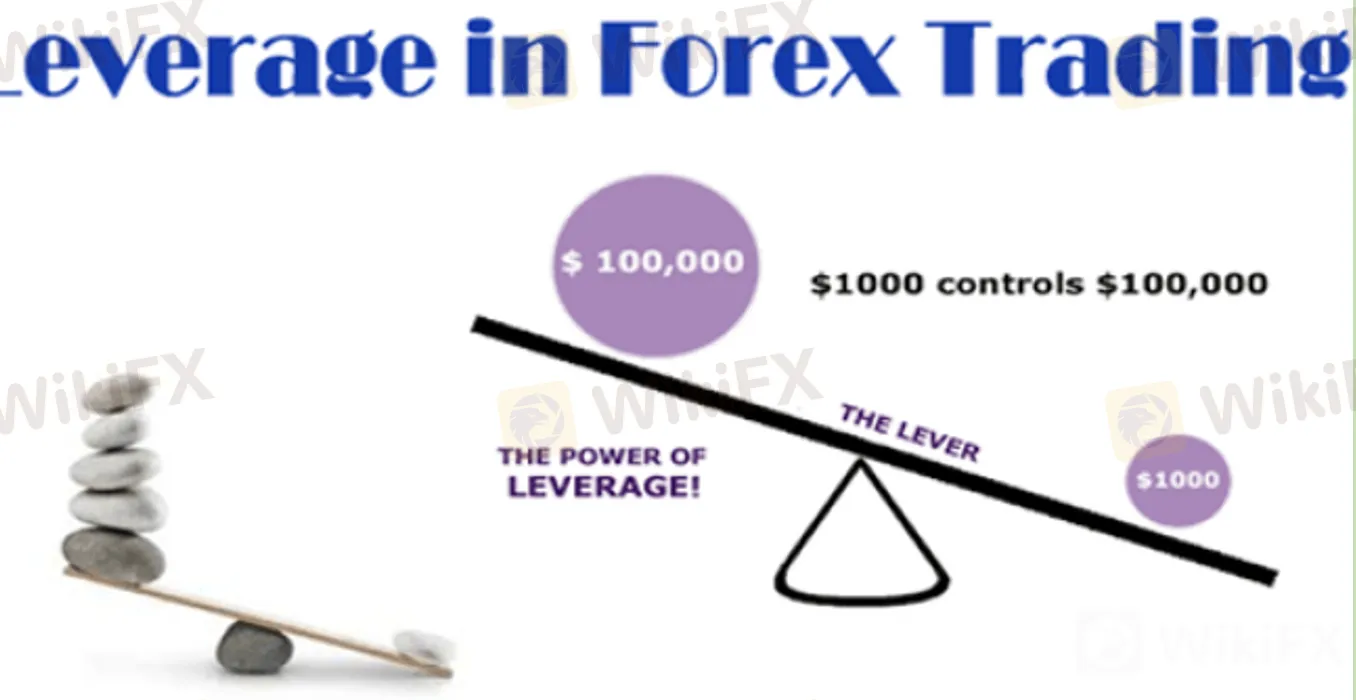

Failing to Trade Forex News? Do This Instead And I can all but guarantee that by the time you finish this rather short post, you’ll have an entirely new understanding of how to approach news events.To get more news about Forex Trading, you can visit wikifx.com official website.

As a quick disclaimer, this won’t be agreeable to everyone. For those with a fundamental edge to their trading, the methods and concepts I discuss here may not apply. But I never use the result of an event to form an opinion about the market.When it comes to trading the news, there are three groups of traders. The first are those who obsessively watch the result of a non-farm payroll report or rate decision. With this information in hand, they pull the trigger without delay.The second group includes the traders who front run the news. These traders attempt to outsmart the market by buying or selling ahead of a high-impact event. The third group, which I’m a part of, uses the resulting price action to formulate an opinion.We (price action traders) sit on the sideline and wait for the dust to settle. Then once all of the noise is gone, we swoop in on the higher time frames and make our decision.

And it doesn’t have to be a buy or sell. Once the dust settles, we’re often left with a whole lot of nothing, which means we do nothing.Make no mistake; we’re still trading the news. A 200 pip pin bar that develops at support due to a surprise rate hike is just the manifestation of the event itself.So if we buy that pin bar, we’re technically buying the result of that surprise rate hike. Do you know why I prefer price action over any other trading method?I prefer it because it tells me the result of any Forex news event. Better still, it paints a collective and objective picture of what just happened.Instead of trading what I think will happen or should happen, I’m trading what actually happened. And when you combine price action signals with the daily time frame, it becomes even more powerful. By the time the session closes at 5 pm EST, market participants have had hours to weigh in on whether they think the event was positive or negative.Well, that and an ego. Let’s face it, opinions and egos aren’t exactly a scarce commodity in the Forex market. I get hundreds of emails each week from Forex traders around the world. One of the most common questions I get asked is whether I think a particular news event will be positive or negative. One of the more popular topics seems to be central bank rate decisions. Traders want to know whether I think a central bank will raise rates or not at their next meeting.This same type of question gets asked about past events as well. For instance, a non-farm payroll report comes out, and the numbers surprise to the upside yet the U.S. dollar weakens. Inevitably, my inbox begins to fill up with questions like – non-farm payroll was positive so why did the USD tank? If you’re a price action trader, it doesn’t matter why it tanked. And if you feel a burning desire to answer the question above, perhaps you’re better off studying fundamentals or utilizing a blended approach. |

||

| TAG. eToro Demo Account | ||

コメント

コメント:0件

コメントはまだありません